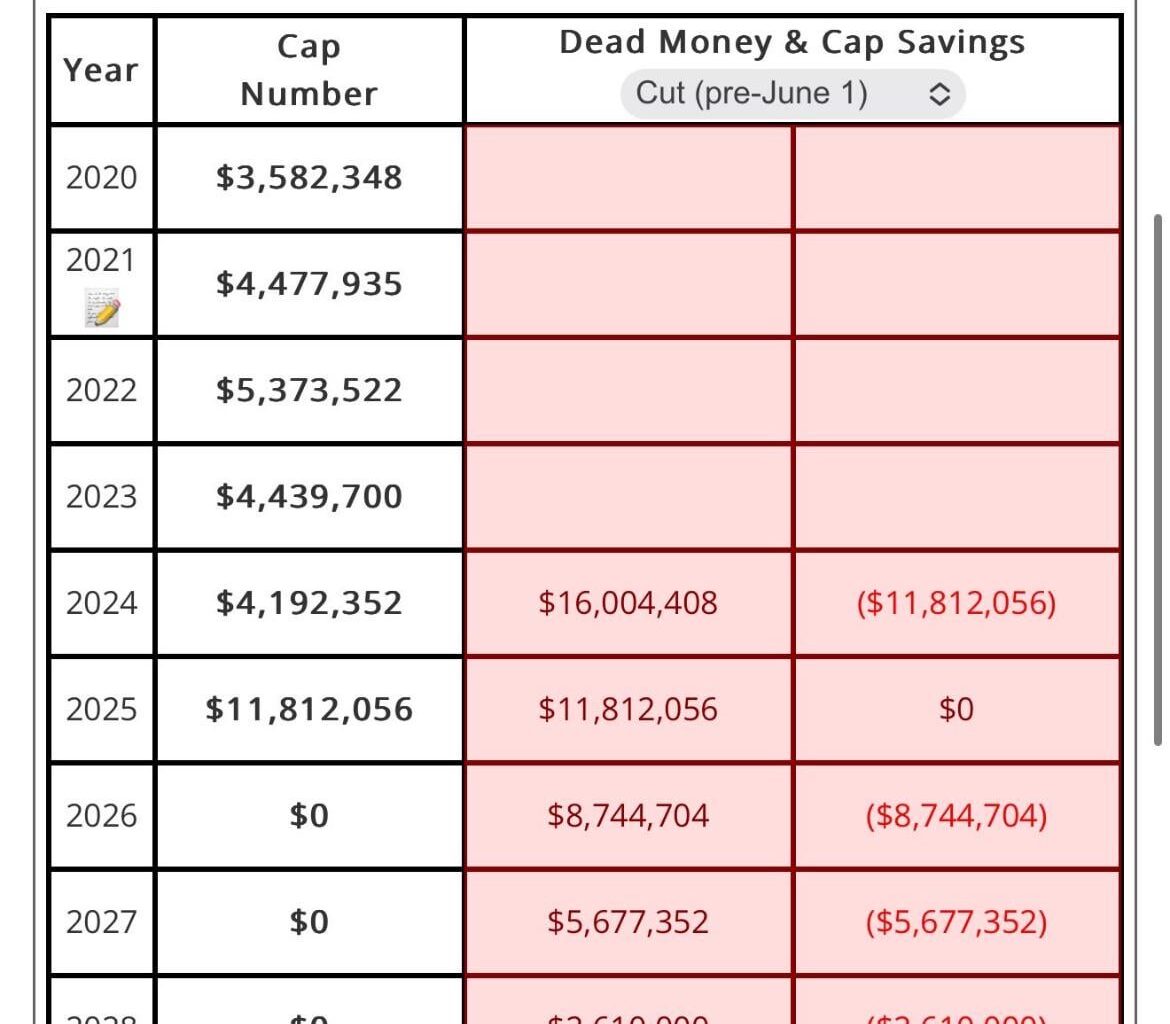

AB loves to push money out under the assumption in the cap will forever keep going up. How does this idea truly play out as these contracts accumulate? For example here’s Jedrick Wills cap info who will won’t play another down for us.

I have a feeling AB is just digging a hole for some other regime to deal with.

6 comments

You should educate yourself on the Browns cap and how the cap works in general.

I understand you’re feeling but it’s wrong. Cap goes up quicker than salaries. Spreading hits out is interest free and even saves money on the overall cap

[https://247sports.com/nfl/cleveland-browns/longformarticle/even-if-deshaun-watson-struggles-the-cleveland-browns-are-fine-in-2025-beyond-236041121/#2485929](https://247sports.com/nfl/cleveland-browns/longformarticle/even-if-deshaun-watson-struggles-the-cleveland-browns-are-fine-in-2025-beyond-236041121/#2485929)

[https://247sports.com/nfl/cleveland-browns/longformarticle/understanding-the-cleveland-browns-spending-philosophy-why-it-is-sustainable-2024-235642851/](https://247sports.com/nfl/cleveland-browns/longformarticle/understanding-the-cleveland-browns-spending-philosophy-why-it-is-sustainable-2024-235642851/)

He’s got void years. If we don’t resign him after this year, all of that dead cap accelerates into 2025. Meaning he’d carry an $11M dead cap next year, but then we’re done. If we re-sign him, then those numbers get tacked on to whatever his extension would be.

So it’s not really hurting us long-term.

Everyone tries to complicate it. It’s honestly quite simple.

First: [NFL cap space by year.](https://www.spotrac.com/nfl/cba) Everything operates under the base assumption that cap will go up ~7-8% every year. This is a very safe assumption barring a global pandemic. This year is $255m, next year is $270m. Using 1.08x per year, that means cap will be roughly $292m/$315m/$340m/$367m over the coming years.

Now let’s use a fake player. I’ll be paying him $27m for a one year deal. Thats 10% of cap space for a $27m one time cap hit.

Or, I can break his hits up over 5 years, for $5.4m a year. That means I’m only accounting for $5.4m in cap this year, and that I have an extra $21.6m in cap to roll over into future years.

That means he’ll have a 2%, 1.8%, 1.7%, 1.6%, 1.5% cap hit given the above rough cap numbers. Or 8.6% of total cap.

So I can pay a guy 10% of cap for a one time $27m payment, or 8.6% of cap for a $5.4m payment while having $21.6m to roll over into future years. Which can and will be used to pay his cap hits.

If I can spend the same amount of cap dollars but save 14% of the cap space, why wouldn’t I? And why wouldn’t it be sustainable?